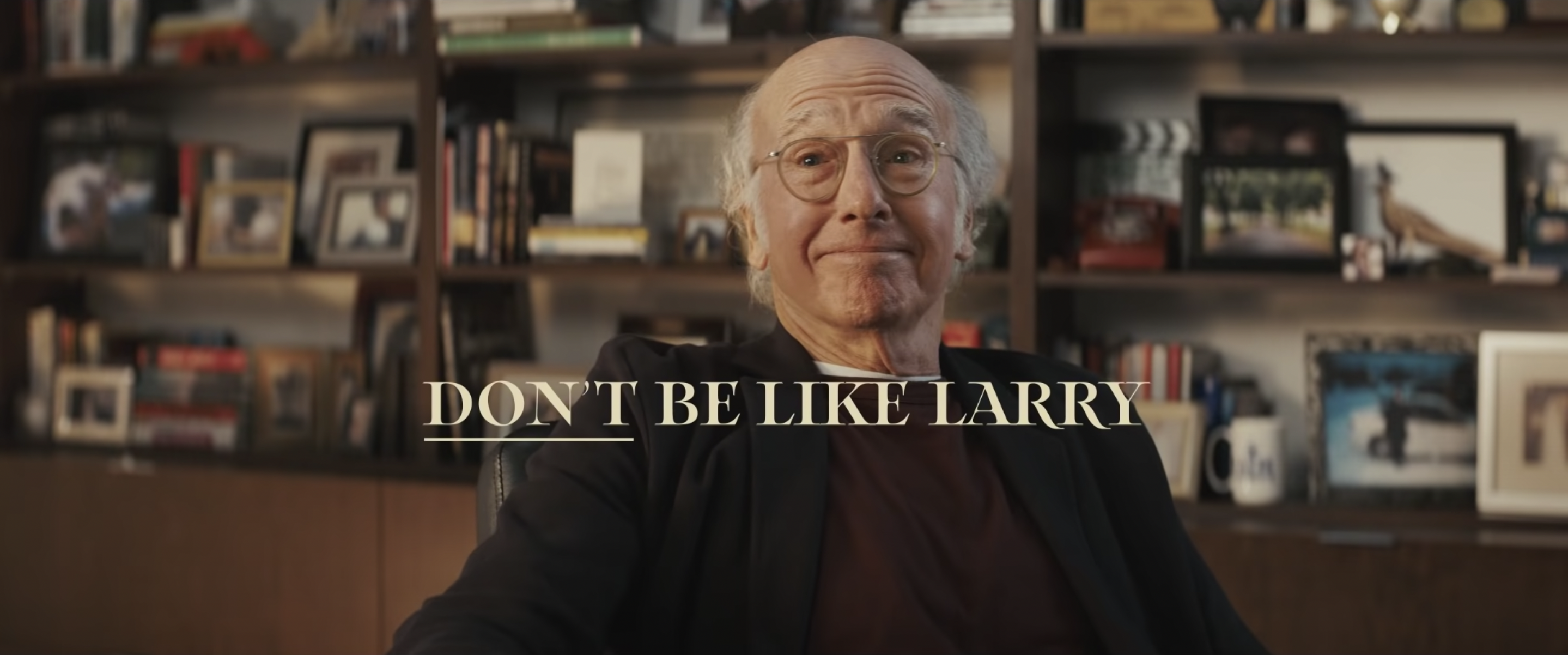

Larry David, FTX Superbowl Commercia

FTX via YouTube

The tech industry’s having a tough time. Only months ago, those who were bragging about their hot tech jobs and (seemingly) hyper-performing Crypto portfolios are probably screaming, crying, gnashing their teeth, and throwing up. And they may or may not be unemployed.

First, the recession is obliterating the stock market as we speak. Then, the summer Crypto proved the “decentralized marketplace” isn’t as impervious as Crypto nerds claimed. And now, the entire tech industry is facing a serious reckoning. It’s meltdown season — and Mercury isn’t even in retrograde.

First, Elon Musk bought Twitter. He subsequently fired a staggering number of employees. He then instituted Twitter Blue, a verification subscription which was a spectacular FAILURE. Most notably, causing the stock price of every significant insulin company to plummet by BILLIONS. It’s a long story, but the takeaway: the best $8 some random Twitter user ever spent.

Meanwhile, major tech companies like Meta, Salesforce, Redfin — and more — have been laying off thousands of employees. Wave after wave of layoffs are tearing through the entire tech sector, leaving thousands bamboozled and bereft. And this — alllll this — is happening while Jeff Bezos is giving away his money to Dolly Parton. I love her, but she has a theme park. These people don’t have jobs!

But this is nothing compared to the drama going on at former-Crypto giant FTX. And somehow, Tom Brady and Gisele are implicated!?! First, the divorce, now this.

Here’s a simplified version of events — and you don’t even need to understand crypto to follow along.

The Super Bowl: The true origins can be traced back to the Super Bowl, where much ad time was devoted to emergent crypto companies vying for the attention of potential investors. Among them: FTX.

January 2022: FTX was valued at an estimated $32 billion. They even had an NBA stadium named after them in Miami. But most prominently, their now infamous Super Bowl ad starring Larry David, who had never appeared in a commercial before. Just imagine that shoot. You should’ve stuck to your guns, Larry.

HERE IS THE FULL FTX TIMELINE:

Nov 2: The real drama started — as it always does — with some shady trades. CoinDesk published a report that exposed that Alameda Research – owned by the same people as FTX – had bought a ton of FTT … FTX’s cryptocurrency.

Nov 6: In a Tweet, the founder of Binance — one of FTX’s biggest competitors — said their company was going to dump their FTX tokens “due to recent revelations that have came to light.” Investors panicked and followed suit. And so began the FTT price plummet.

But with all their investors cashing in their coins, FTX was on the hook for all that money — which it could not afford to pay out. This is when things started to look really hairy.

Nov 8: With their tails between their legs, FTX went to Binance for an out. Binance agreed to acquire FTX.

Nov 9: Just kidding! Whatever was in those docs must have scared off Binance because they pulled out of the deal just a day later. Does this feel like an episode of Succession to you, too?

Nov. 11: FTX had no way to repay all this money. And any potential buys were not going anywhere near this dumpster fire. So FTX was forced to file for bankruptcy. 30-year-old CEO and founder Sam Bankman-Fried resigned.

He tweeted that he was “really sorry,” though! SO maybe that counts for something. Cue the world’s tiniest violin playing in the background.

u201cFun fact:nnIf you spent $1,000 shorting the 2022 Super Bowl advertisers, you’d be a billionaire today:nnu25abufe0f FTXnu25abufe0f Carvananu25abufe0f DraftKingsnu25abufe0f Uber Eatsnu25abufe0f Meta Oculusnu25abufe0f Rocket Mortgagenu25abufe0f Coinbasenu25abufe0f Vroomnu25abufe0f Salesforcenu25abufe0f GMu201d— Chris Bakke (@Chris Bakke) 1667931782

But there’s more!

Later that day, reports emerged that FTX transferred $10 BILLION to Alameda — the same sister company mentioned above. That’s right, the one that started this mess — sparking controversy about how much access top leaders had to the company’s finances.

Nov 13: Where’s the money? New reports reveal that those BILLIONS of dollars had just … disappeared?

Nov 14: Now the cops are involved. Where the hell is the money, man? Regulators are trying to get to the bottom of this, while looking into criminal liabilities.

Nov 16: Here comes the class action. Defendants are suing FTX’s Bankman-Fried for misleading information. But the walls are now closing in on celebrities who appeared in FTX commercials, including Tom Brady, Gisele Bundchen, Stephen Curry, Larry David, and Shaquille O’Neal.

“FTX’s fraudulent scheme was designed to take advantage of unsophisticated investors from across the country, who utilize mobile apps to make their investments,” the lawsuit alleges. “As a result, American consumers collectively sustained over $11 billion dollars in damages.”

There you have it. But don’t hold your breath — there’s more to come, I’m sure. In fact, the documentary is already in the works

And if you still don’t follow, here are some TikToks tracking the drama:

@yourrichbff SBF bears a striking resemblance to Bernard Madoff. #money #crypto #ftx #finance #sbf #news #binance #alameda #bitcoin #ethereum #ftt #coin #cryptocurrency

@dumpster.doggy the drama